Sterling Trust Ira

With this guide, you’ll study every part there's to learn about investing in gold and silver with a precious metals IRA. Since the mama bear market reached new lows this month, pundits have been stunned the worth of gold bullion did not soar throughout the sort of financial cataclysm many gold "bugs" supposedly had been gleefully anticipating. Sep 14, 2022 - The funds buy precious metals and bodily gold. The Blanchard and firm site is well designed and simple to navigate, with digestible chunks of data that won’t overwhelm the casual reader, and there is mostly sufficient depth to fulfill more seasoned clients.

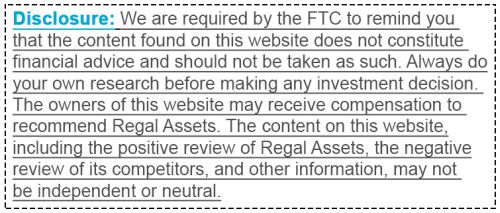

It takes just a few minutes to open an account on the company’s website, and Noble Gold Funding presents a wide range of bodily gold and silver bullion bars and coins. Mutual funds and alternate-traded funds that put money into the valuable metal or shares of mining business use a extra liquid and inexpensive technique to take a position. We stand by our dedication to solely ever recommend companies primarily based on their advantage, so if you see companies in our beneficial lists you might be assured they’re there as a result of they're glorious - not as a result of they’ve paid us. Whether or not you solely have a 401(k), multiple tax-advantaged retirement accounts, otherwise you choose to fund a Roth gold IRA with after-tax dollars, you’ll want to decide on a funding supply for your gold IRA. These investors may resolve to begin wanting elsewhere if they want to search out other funding options.

As a result of IRAs are meant for retirement financial savings, there's usually an early withdrawal penalty of 10% if you're taking money out before age 59½. There are some notable exceptions-withdrawals for educational expenses, for example, and for first-time residence purchases, amongst others. Possibly you’re new to investing or at the moment benefiting from your company’s 401k plan. ThrustGold has established relationships with mints world wide and entry to quite a few IRA-eligible gold coins and bars, together with many which are minted for ThrustGold. The stock market is extremely unstable nowadays and inflation brought on by limitless money printing and reckless authorities spending has precipitated increasingly buyers to seek the security of valuable metals to guard their retirement. The entire point of a gold IRA is to give your retirement portfolio exposure to assets that are not part of the stock market system of stocks, bonds, ETFs, funds, and trusts. Quantitative research by CPM Group and different monetary research firms have demonstrated that adding even slightly gold and silver to a diversified portfolio of stocks and bonds improves long-term efficiency. Investing in gold and silver coins and bars is different from investing in stocks. Gold PAMP Suisse Lunar bars are additionally out there.

The funds are transferred usually by way of bank wire, and once they have been deposited into your Precious Metals IRA account, you are ready to invest! best physical gold ira may transfer the funds from your present retirement account instantly into a gold IRA with a direct rollover. However in the event you tried to reap rewards from proudly owning precious metals outdoors of an IRA, you’d face further costs like capital beneficial properties taxes as the price fluctuates. Gold, on the other hand, isn’t affected by financial crises in the same manner as stocks and bonds.